Liability Cap

What is a liability cap?

Annual cap vs contract duration cap

Maximum liability cap

Minimum liability cap

Liability cap exclusions

How to calculate liability cap?

What is a reasonable liability cap?

What is an aggregate liability cap?

Liability cap for data breach

Liability cap for software

Can you cap liability under GDPR?

Can you cap liability for gross negligence?

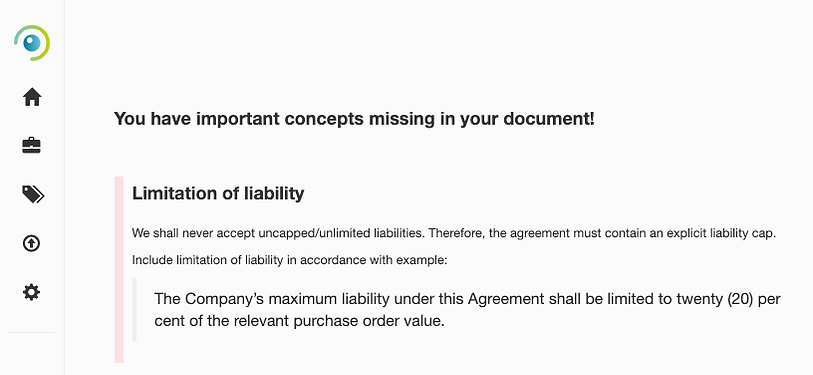

Example of feedback regarding a missing Liability cap for the selling party.

What is a liability cap?

A liability cap is a clause in a contractual agreement that limits the amount that a party is liable for in the event of a breach of contract or any sort of negligence. This clause is usually a mechanism used to manage the risk that a company exposes itself to when entering into commercial agreements. For this reason, liability caps are usually the most heavily negotiated contract terms when it comes to reviewing and dealing with liabilities and commercial agreements. Standard market practice when it comes to liability caps will ultimately hinge on the bargaining power of each respective party which in turn, will affect how a liability cap is structured.

Annual cap vs contract duration cap

A major consideration when it comes to structuring a liability cap is whether the liability applies on an annual basis or through the entire lifetime of the contract.

Annual cap clauses are normally preferred by suppliers due to the fact that annual caps can decrease the maximum liability that a supplier is exposed to each contract year to a lesser amount. Customers also benefit from an annual cap as it may provide the customer with certainty that an amount is recoverable from the supplier.

Maximum liability cap

In instances of contract negotiation, an aggregate upper limit for liability pertaining to direct damages are commonplace. Parties want to know for certain the amount of risk they expose themselves to in relation to the commercial gain expected. The approximation of this maximum liability cap may as a result tie the cap in one form or another to amounts paid for products or services. The maximum liability cap should be listed in your company's contract review policy or guidelines.

Minimum liability cap

In the instances where breaches occur early in a contractual relationship, a minimum liability cap clause is also commonplace. This happens when an aggrieved party is in a situation where there are little to no remedies to a breach. This may occur when the breach occurred so early that the substantive commercial agreement has not taken place.

Liability cap exclusions

The common exceptions to caps on liabilities normally arise during the contract negotiation phase. At this point, there is the appreciation of certain risks that are deemed either appropriate or inappropriate for a party to bear without limits. These exceptions are carved out during this phase and may normally include topics such as special damages and disclaimers of indirect damages. Other considerations may come in the form of:

-

Indemnification obligations such as intellectual property infringement claims

-

Liabilities arising from NDAs (Non-Disclosure Agreements)

-

Liabilities arising from Domestic Law

-

Liabilities arising from fraud

-

Liabilities arising from wilful misconduct and/or gross negligence

-

Liabilities arising from payment obligations and stipulations.

Regarding these liability cap exclusions, each exception should be individually addressed, such as the extent of liability to the types of damages that can be recovered (e.g. indirect or direct).

How to calculate a liability cap?

The calculation of the liability cap may be calculated as a multiple of the fee that the other party would be liable for. The simplest form of a liability cap may be found in the form of a monetary cap, which sets a limit to the professional indemnity insurance that they would pay out. However, each contract is written for a unique set of commercial circumstances, meaning a process of risk assessment needs to be taken to tailor fit the liability cap to the specifics of the commercial agreement. These specifics may come in the form of how liabilities stemming from the nature of services, the method of delivery, public and professional liabilities, insurance. Ensure that you understand the definition of the liability cap when reviewing the contract.

Before calculating the liability cap, it may be necessary to assess the risks associated with the contract. This process requires the identification of what poses a risk, an estimation of the likelihood and quantitative impact, an analysis of the results, and the stipulation of a suitable amount for the liability cap that would prevent loss.

Depending on the liability classes, assessments such as the ones mentioned above may be pivotal for the adequate estimation and calculation of liability caps.

What is a reasonable liability cap?

In theory, when determining what is reasonable when setting and negotiating liability caps, it would be optimal for the parties to try to avoid as much risk as possible. As a result, parties would try to set the lowest possible liability cap in order to minimize their risk. However, reasonableness will ultimately be an assessment made by the other party, and by setting a very low liability cap, this could put off the other party causing a disagreement to those terms.

What is an aggregate liability cap?

The aggregate liability cap is a limitation to the maximum total amount a party will pay for certain claims during the period of the commercial agreement. This total amount is cumulative and counts for the sum of all payouts arising from all claims made. As well as a total amount, an aggregate liability cap may come in the form of a capped amount per claim and a stipulation regarding the time period.

Liability cap for data breach

Considerations for liability caps in the instance of data breaches are becoming more and more relevant in today’s digital age. A breach of data in the form of a leak of Intellectual property or any other sensitive information could potentially and seriously harm businesses. As a result of this growing threat, ‘super caps’ are used more frequently as a separate and higher limit of liability that details the types and amounts of damages that one may be liable for. Make sure you understand these caps when reviewing the contract.

Liability cap for software

A liability cap specifically for software clauses is normally the most crucial clause that is negotiated when it comes to software license agreements. This is because the amount and type of recoverable damages are extremely important to limit significant risk exposure within the realm of software license agreements.

The status quo in these agreements normally comes in the form of a liability cap that provides no protection for the licensee. Only limited occasions for a potential refund pose serious risks. From the licensee’s perspective, the liability cap should be mutual and not one-sided. Protection from damages should be at a minimum the same as the vendor and include most, if not all, the types of damages available to the vendor.

The common practice for SaaS companies will be to limit liability in times of outages or crashes, protecting the developer in situations that are often out of their control. The wording does not expressly state that the developer does not assume any responsibility, only that necessary precautions will be taken, in situations that are beyond their control, and therefore, liability cannot be claimed. Best practices will walk the line between protecting from liability and taking the appropriate responsibility for occasions out of their control.

Can you cap liability under GDPR?

The General Data Protection Regulation 2016/679 (GDPR) is a regulation in EU law on data protection and privacy within the EU and European Economic Area. This overarching law dictates the conditions of internet and data privacy in every possible way, with data breaches being a large consideration for corporations. Even companies outside of the European Economic Area will be affected by GDPR when processing the data of European consumers. Important aspects regarding liability cap clauses and the GDPR are, for instance, even with the extensive limitation of liability clauses, under the GDPR, supervisory authorities may still impose a fine. This fine cannot be limited. Liability insurance could also be affected as your old coverage may need to be adapted to the possible GDPR fines that extend up to 4% of worldwide turnover. There might not be a way to object to this. However, ensure you understand your obligations when reviewing the terms.

Liability between controllers and third-party data processors may also be held equally responsible, regardless of who was at fault for the data breach. This obligates both sides to scrutinize and make sure both sides have sufficient data protection standards that are GDPR compliant.

Can you cap liability for Gross Negligence?

Gross negligence in the context of commercial agreements may be interpreted as more severe than ‘negligence’ but will depend on the context in which it is used. Gross Negligence may be defined as more than a failure of proper skill and care, but a serious disregard or indifference to an obvious risk. It is common practice for clauses such as Gross Negligence or Willful Misconduct to be excluded from the limitation of liabilities clauses.

In any event, Gross Negligence may or may not be a negligence clause that can be prohibited depending on the domestic laws. Hence, note the governing law when reviewing the contract.

Disclaimer

Please note that this document is not legal advice. Legly, and its representatives, are not responsible for the content herein or the suitability for your company’s business. We recommend you use this in conjunction with legal advice and not as a substitute.